Government Shutdown January 2018

This information is from the 2013 government shutdown. While it seems unlikely that the government is going to shutdown in October 2015, banks and credit unions seem to be solidifying similar plans, just in case.

Many military-oriented banks and credit unions have organized policies regarding delay of military pay due to government shutdown. If your bank or credit union is not listed here, mention it in the comments and I'll see what I can find.

USAA

Updated 26 September 2013: Roger Wildermuth from USAA has confirmed the following information:

USAA is once again prepared to offer a zero-interest payroll advance loan to affected military members with existing direct deposit at USAA if military pay is interrupted by a government shutdown. We also have a number of other solutions, such as special payment arrangements, to help USAA members who receive government payments and find themselves in financial distress due to a shutdown.

Navy Federal Credit Union

In the event that 15 October 2013 active duty military pay is delayed, Navy Federal Credit Union (NFCU) will advance the amount of a usual pay deposit.

In addition, NFCU has an ongoing program for government employees affected by sequestration. Offers include:

- Special 3.00% APR Overdraft Line of Credit* If you are a federal government civilian employee, have direct deposit with Navy Federal, and are subject to furlough, you're eligible for a special rate on our Checking Overdraft Line of Credit.

- Loan Assistance: We are prepared to work with you on any Navy Federal loan payments.

- Credit Cards: Expedited approvals for line increases for your existing Navy Federal credit card.

- Personal Loans: Share Savings and Certificate pledged loans can provide instant funds without dipping into savings accounts. Rates are set at the share or certificate rate plus 2.00% APR. Personal expense loans with no collateral are also available.

- Penalty-free Early Withdrawal on Certificates: If you need to redeem a Navy Federal Certificate prior to its maturity, we'll waive any early withdrawal penalties.

Pacific Marine Credit Union

Effective 26 September 2013, Pacific Marine Credit Union has made the following announcement:

In the case of a government shutdown Pacific Marine Credit Union will post the October 15th government employee payrolls for members with direct deposit. This includes active duty and retired military, Department of Defense appropriated and non-appropriated, social security, and disability. For affected members without direct deposit, PMCU will work on an individual basis to provide assistance in the best manner possible. For additional information please watch our website.

Marine Federal Credit Union

Marine FCU has announced that "Marine FCU will post government employee payrolls for members with direct deposit. This includes active duty and retired military, Department of Defense appropriated and non-appropriated, social security, and disability." Details are to be forthcoming on the website.

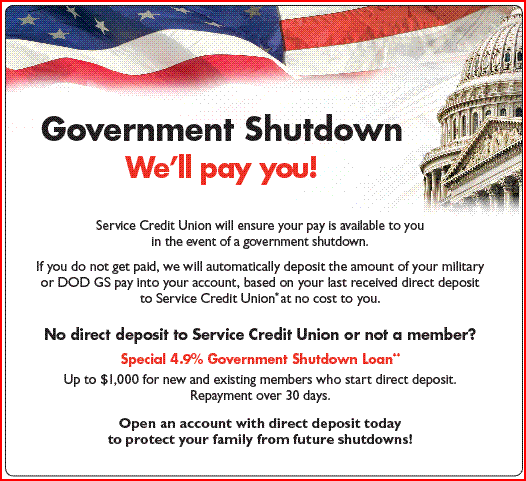

Service Credit Union

Updated 26 September 2013: Service Credit Union has announced that they will be crediting deposits for military and Department of Defense (DOD) GS pay:

If you do not get paid, we will automatically deposit the amount of your military or DOD GS pay into your account, based upon the amount of your last received direct deposit to Service Credit Union at no cost to you.

In addition, Service Credit Union is offering a $1,000 loan at 4.9% interest for existing customers, and customers who switch to Service Credit Union and set up a direct deposit.

Service Credit Union also several ongoing offers for members affected by sequestration. These include:

- 0% loan, up to $6,000, for member who use Service Credit Union for direct deposit of their government pay

- penalty-free withdrawal of funds in Certificates of Deposit

While Service Credit Union has not yet announced their plans in the event of a government shutdown in 2013, their plans in 2011 included the crediting of direct deposit pay and allotments to military service members and their families.

Belvoir Credit Union

Belvoir Credit Union has announced the following offers to help any member affected by a government shutdown:

- Emergency Loans: Borrow up to $5,000 at a fixed-rate of 4.99% APR* (0% APR for the first 60 days), maximum term is 12 months, 1st payment may be deferred for 60 days.

- Loan Workouts: Members may work with a loan officer to determine if a loan workout program can be created to help ease your financial hardship.

- Skip-A-Pay: Skip a regular consumer loan payment at no charge.

- Penalty Free Share Certificate Withdrawal: Take out money in your certificate to help you now without the associated fee.

Air Force Credit Union

Air Force Credit Union has published the following statement:

Air Force Federal Credit Union remains hopeful the ongoing legislative impasse will be resolved and a suspension of federal government payments will be averted on Tuesday, October 1, 2013. If there is no resolution to debate on the debt ceiling, the federal government may opt to defer making payments. This could impact government pensions of retired federal employees, social security recipients, and the military and/or other federal employees.We are keenly aware of the significant economic hardship such an event would impose on our military and DoD civilian members and their families. Air Force FCU is prepared to make accommodations for affected members.

Air Force FCU is indebted to its military members and we are extremely grateful for their dedication and the sacrifices they make to preserve our Nation’s freedoms. We are honored that they have entrusted us with their financial affairs and their financial well-being is our top priority. We will endeavor to accommodate every affected member’s needs during this difficult period.

If you have any questions, please contact us by phone at 210.673.5610 or 800.227.5328, through online live chat or by visiting one of our nine branch locations. Our Member Contact Center is open 24|7|365, including holidays, to take your calls.

Honestly, this doesn't actually say anything. I'd love to hear if someone calls them!

Keesler Federal Credit Union

Keesler Federal Credit Union has announced that it will provide a one-time pay advance if a government shutdown delays 15 October 2013 military pay. In addition, they are offering penalty-free withdrawals from Certificates of Deposits, loan assistance, and financial counseling.

That's all I have for now. Please include any questions or additional information in the comments, and I'll keep this post updated as more information becomes available.

**All information is provided by Military.com https://www.military.com/paycheck-chronicles/2013/09/25/banks-and-credit-unions-release-government-shutdown-information